A Proper Manual Payment Certification Includes Whose Signature

Arias News

Mar 15, 2025 · 6 min read

Table of Contents

A Proper Manual Payment Certification: Who Needs to Sign?

Manual payment certifications are crucial for maintaining financial accuracy and accountability within any organization. They serve as irrefutable proof that a payment has been processed correctly and authorized by the appropriate individuals. But the question of who exactly needs to sign this crucial document often leads to confusion. This comprehensive guide will delve into the specifics of a proper manual payment certification, examining the roles and responsibilities of each signatory and highlighting the importance of a robust and auditable payment process.

Understanding the Purpose of Manual Payment Certification

Before diving into the specifics of signatures, let's clarify the overarching purpose of manual payment certification. Essentially, it acts as a multi-layered verification system designed to prevent fraud, minimize errors, and ensure compliance with internal policies and external regulations. This certification process typically involves several stages, each with its own set of checks and balances. The ultimate goal is to provide a clear, auditable trail of every payment made, protecting both the organization and its stakeholders.

Key Benefits of a Robust Certification Process:

- Fraud Prevention: Multiple signatures act as a deterrent against fraudulent payments. The requirement for multiple approvals significantly increases the difficulty of manipulating the system.

- Error Reduction: The review process inherent in manual certification significantly reduces the likelihood of errors in payment amounts, recipient details, or account numbers.

- Compliance Adherence: A well-defined certification process demonstrates adherence to internal controls, industry best practices, and relevant regulatory requirements (e.g., Sarbanes-Oxley Act).

- Improved Auditability: A clear audit trail allows for easy tracking of payments, simplifying internal and external audits.

- Enhanced Accountability: Clearly defined roles and responsibilities associated with each signature ensure accountability for every payment made.

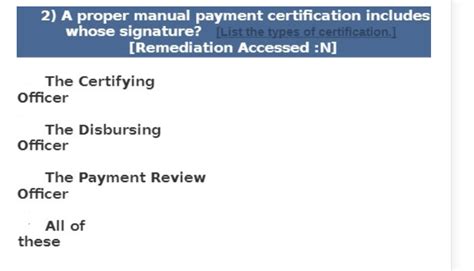

Who Should Sign a Manual Payment Certification? The Critical Roles

The specific individuals required to sign a manual payment certification vary depending on the organization's size, structure, and internal controls. However, certain key roles consistently appear in most effective systems. The number of signatures needed will depend on internal risk assessment. A small organization might need fewer signatories than a large multinational corporation with complex financial operations.

1. The Requestor: Initiating the Payment Process

The process invariably begins with an individual who requests the payment. This could be an accounts payable clerk, a department manager, or even a senior executive, depending on the nature and amount of the payment. The requestor's signature confirms that the payment is legitimate, necessary, and accurately reflects the goods or services received. This initial signature validates the basic information: the vendor, amount, and purpose of the payment.

Key Responsibilities of the Requestor:

- Accuracy of Information: Ensuring all information provided is accurate and complete.

- Supporting Documentation: Providing supporting documentation (invoices, contracts, etc.) to justify the payment.

- Authorization Approval: Verifying that the payment has been appropriately authorized within the organization's hierarchy.

2. The Approver: Authorizing the Payment

This role is crucial for controlling expenditures and ensuring that payments align with the organization's budget and financial policies. The approver's signature confirms that the payment is authorized and falls within the established spending limits and procedures. This individual holds a position of authority and carries the responsibility of reviewing the payment request thoroughly before giving approval. This could be a department head, a finance manager, or even a chief financial officer (CFO), depending on the amount of the payment and company policy.

Key Responsibilities of the Approver:

- Budget Compliance: Confirming that the payment is within the allocated budget.

- Policy Adherence: Ensuring the payment complies with all relevant internal policies and procedures.

- Review of Supporting Documentation: Carefully reviewing all supporting documentation to validate the legitimacy of the payment.

3. The Processor: Processing and Verifying the Payment

This individual is typically responsible for the actual processing of the payment, whether it's cutting a check, initiating a wire transfer, or entering the payment information into the accounting system. Their signature confirms that the payment has been processed according to the approved request and that all necessary controls have been followed. This often falls to an accounts payable specialist or a member of the finance department.

Key Responsibilities of the Processor:

- Accurate Data Entry: Verifying the accuracy of all payment details before processing.

- Payment Method Compliance: Ensuring the payment is made using the appropriate method (check, wire transfer, etc.).

- Reconciliation: Reconciling the payment with the supporting documentation.

4. The Auditor (Optional but Highly Recommended): Providing an Independent Review

In larger organizations, or for high-value payments, an independent auditor might also sign the certification. This provides an additional layer of verification and strengthens the internal control system. The auditor's role is to perform an independent review of the payment process, ensuring adherence to all policies and procedures. Their signature acts as an ultimate verification of the payment's integrity.

Key Responsibilities of the Auditor:

- Independent Verification: Performing an independent review of the entire payment process.

- Compliance Assurance: Ensuring compliance with all relevant policies, procedures, and regulations.

- Fraud Detection: Identifying any potential instances of fraud or error.

Best Practices for Manual Payment Certification

Implementing a robust manual payment certification process requires more than just identifying the right signatories. Best practices must be followed to ensure the system is effective and provides the intended levels of security and control.

1. Clear and Concise Documentation

The certification form itself must be meticulously designed to be clear, concise, and easy to understand. It should include clear instructions, sufficient space for signatures and dates, and designated areas for relevant information.

2. Defined Roles and Responsibilities

Clear definitions of the roles and responsibilities of each signatory should be documented and readily accessible to all involved. This avoids confusion and ensures that each individual understands their obligations.

3. Segregation of Duties

Crucially, there should be a clear separation of duties among the signatories. No single individual should be involved in both initiating and approving payments, or processing payments and reconciling accounts. This separation of duties is a cornerstone of robust internal controls.

4. Regular Review and Updates

The manual payment certification process should be subject to regular reviews and updates. This ensures that it remains effective and relevant, keeping pace with changes in the organization's structure, policies, and external regulatory requirements.

Consequences of Improper Certification

Failing to follow proper procedures in manual payment certification can have significant consequences, impacting both the organization and individual employees.

Potential Risks:

- Financial Loss: Improper certification can lead to fraudulent payments or errors that result in financial loss for the organization.

- Reputational Damage: A breakdown in the payment certification process can damage the organization's reputation with vendors, stakeholders, and regulatory bodies.

- Legal Ramifications: Non-compliance with internal policies or external regulations can lead to significant legal penalties and liabilities.

- Internal Control Weakness: A flawed process exposes the organization to increased risks of fraud, error, and non-compliance.

- Employee Disciplinary Action: Individuals who fail to adhere to established procedures can face disciplinary action, including termination.

Conclusion: A Secure and Efficient System

A properly implemented manual payment certification process is an essential element of any organization's financial control system. By clearly defining the roles of each signatory, implementing robust internal controls, and adhering to best practices, organizations can significantly reduce the risk of fraud, error, and non-compliance. Understanding who needs to sign and why is paramount to building a secure and efficient system that safeguards financial resources and maintains the organization's integrity. Regular review and updating are key to maintaining the effectiveness of the process in the face of evolving operational needs and regulatory requirements. Remember that the goal is not just to comply, but to create a system that fosters transparency, accountability, and confidence in the organization's financial management.

Latest Posts

Latest Posts

-

How Many Cups Is 12 Ounces Of Pasta

Mar 17, 2025

-

How Much Is 2 Liters Of Water In Bottles

Mar 17, 2025

-

What Did The Blind Old Buck Say To His Doe

Mar 17, 2025

-

Time To Say Goodbye Meaning Of Song

Mar 17, 2025

-

How Many Words Can You Make Out Of Merry Christmas

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about A Proper Manual Payment Certification Includes Whose Signature . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.