How Much Is 2.5 Percent In Dollars

Arias News

Mar 29, 2025 · 4 min read

Table of Contents

Decoding 2.5 Percent: Understanding its Dollar Value in Different Contexts

Calculating 2.5 percent of a dollar amount might seem straightforward, but its practical application varies wildly depending on the context. This comprehensive guide explores how to calculate 2.5 percent in dollars and how this seemingly small percentage impacts various financial situations, from taxes and interest rates to discounts and commission calculations. We'll delve into practical examples, providing a clear understanding for both beginners and those seeking a deeper grasp of percentage calculations.

Understanding Percentage Calculations: A Refresher

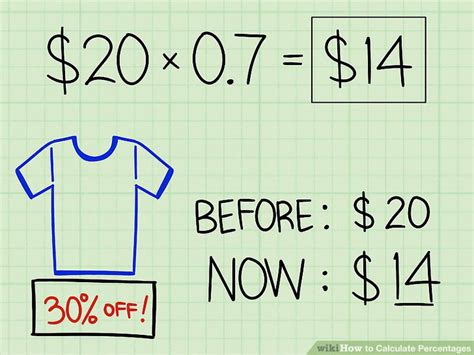

Before we dive into the specifics of 2.5 percent, let's quickly review the basics of percentage calculations. A percentage is a fraction of 100. To calculate a percentage of a number, we follow these steps:

- Convert the percentage to a decimal: Divide the percentage by 100. For example, 2.5% becomes 2.5 / 100 = 0.025.

- Multiply the decimal by the total amount: This gives you the percentage of the total amount.

Let's illustrate with a simple example: What is 2.5% of $100?

0.025 x $100 = $2.50

This means 2.5% of $100 is $2.50.

Calculating 2.5% of Different Dollar Amounts

Now, let's explore how 2.5% translates to different dollar amounts. This table demonstrates the calculation for various common values:

| Dollar Amount | 2.5% Calculation | Result ($) |

|---|---|---|

| $100 | 0.025 x $100 | $2.50 |

| $500 | 0.025 x $500 | $12.50 |

| $1,000 | 0.025 x $1,000 | $25.00 |

| $5,000 | 0.025 x $5,000 | $125.00 |

| $10,000 | 0.025 x $10,000 | $250.00 |

| $100,000 | 0.025 x $100,000 | $2,500.00 |

| $1,000,000 | 0.025 x $1,000,000 | $25,000.00 |

This table highlights the linear relationship between the initial amount and the resulting 2.5% value. As the initial amount increases, the 2.5% value increases proportionally.

Real-World Applications of 2.5 Percent in Dollars

Understanding how to calculate 2.5 percent isn't just an academic exercise. It has significant practical implications in several financial scenarios:

1. Sales Tax:

In some regions, the sales tax rate might be 2.5%. If you buy an item for $200 and the sales tax is 2.5%, you'd pay an additional 0.025 x $200 = $5.00 in tax. Your total cost would be $205.00.

2. Interest Rates:

A 2.5% interest rate on a loan or savings account significantly influences the final amount. Imagine a $10,000 loan with a 2.5% annual interest rate. After one year, the interest accrued would be $250.00. The total amount owed after one year would be $10,250.00. Note that the effect compounds over time.

3. Discounts and Sales:

Retailers often offer discounts expressed as percentages. A 2.5% discount on a $50 item would save you 0.025 x $50 = $1.25, reducing the final price to $48.75.

4. Commission:

Salespeople often earn a commission based on their sales. If a salesperson earns a 2.5% commission on a $20,000 sale, they'd receive 0.025 x $20,000 = $500.00.

5. Property Taxes:

Property taxes are often calculated as a percentage of the property's assessed value. A 2.5% property tax on a property assessed at $300,000 would result in a yearly tax of 0.025 x $300,000 = $7,500.

6. Investment Returns:

Investment returns are expressed as percentages. A 2.5% return on a $50,000 investment would yield $1,250.00. This is a modest return, and factors such as inflation should be considered to determine the real return.

Beyond Simple Calculations: Compound Interest and Inflation

While the basic calculation of 2.5% is straightforward, more complex financial situations involve compound interest and inflation.

Compound Interest: With compound interest, the interest earned is added to the principal amount, and subsequent interest calculations are based on the increased total. This effect snowballs over time, significantly impacting the final amount.

Inflation: Inflation erodes the purchasing power of money over time. A 2.5% return on an investment might seem good, but if inflation is also at 2.5%, the real return is zero. Understanding inflation is crucial to interpreting the true value of a percentage return.

Using Online Calculators and Spreadsheet Software

For more complex calculations involving compound interest or other variables, utilizing online calculators or spreadsheet software like Microsoft Excel or Google Sheets is highly recommended. These tools automate the calculations, reducing the risk of errors and saving you time. Many free online calculators are available by searching "percentage calculator" on your preferred search engine.

Conclusion: Mastering the Significance of 2.5 Percent

Understanding how to calculate 2.5 percent in dollars is a fundamental skill with broad applications in personal finance, business, and various other aspects of life. From everyday transactions involving sales tax and discounts to more complex financial decisions concerning investments and loans, the ability to quickly and accurately calculate percentages is invaluable. By grasping the principles outlined in this guide, you'll be better equipped to make informed financial decisions and navigate the world of percentages with confidence. Remember to always consider the context – sales tax is different from interest rates or investment returns – and use the appropriate tools to tackle more complicated calculations. The seemingly small 2.5% can have a significant impact depending on the total amount involved, so understanding its calculation is crucial for financial literacy.

Latest Posts

Latest Posts

-

How Many Oz Is 4 Liters Of Water

Mar 31, 2025

-

How Much Is 400 Ml In Ounces

Mar 31, 2025

-

How Many 5 Dollar Bills In A Bundle

Mar 31, 2025

-

What Is Half Of 1 8 Tsp

Mar 31, 2025

-

Sometimes You Feel Like A Nut Sometimes You Dont Lyrics

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about How Much Is 2.5 Percent In Dollars . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.