How To Write 1350 On A Check

Arias News

Apr 05, 2025 · 5 min read

Table of Contents

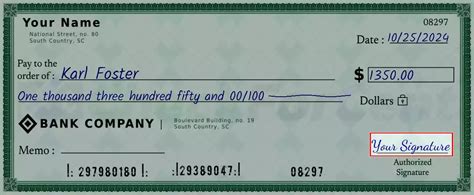

How to Write "1350" on a Check: A Comprehensive Guide

Writing a check might seem straightforward, but ensuring accuracy is crucial to avoid complications. This comprehensive guide provides a detailed walkthrough on how to correctly write "1350" on a check, covering various scenarios and addressing common mistakes. We'll delve into the intricacies of numerical and alphabetical representation, proper placement, and essential security measures.

Understanding the Anatomy of a Check

Before we jump into writing "1350," let's review the essential components of a check:

- Check Number: A unique identifier for the specific check.

- Date: The date the check is issued.

- Payee: The person or entity receiving the payment.

- Numerical Amount: The amount written numerically.

- Alphabetical Amount: The amount written in words.

- Memo/Notes Section: An optional section for adding a brief description of the payment.

- Signer's Signature: The signature of the account holder authorizing the payment.

Writing "1350" on a Check: A Step-by-Step Guide

The key to correctly writing "1350" on a check lies in accuracy and consistency between the numerical and alphabetical amounts. Any discrepancy can lead to payment delays or rejection.

Step 1: Write the Date

Start by writing the date in the designated area. Use the standard MM/DD/YYYY format or DD/MM/YYYY depending on your regional conventions.

Step 2: Write the Payee's Name

Carefully write the name of the recipient (payee) in the "Pay to the Order Of" line. Ensure the name is accurate and legible to prevent any confusion.

Step 3: Write the Numerical Amount

This is where you write "1350" numerically. Write it clearly and precisely in the designated box, aligning it to the left. Ensure that there is no space between the number and the dollar ($) sign. Incorrect spacing can lead to alteration. For instance, if you leave a space between the $ and 1350, it could potentially be altered to "$13,500".

Step 4: Write the Alphabetical Amount

This is the critical step to ensure accuracy and prevent fraud. Write out "One Thousand Three Hundred Fifty" in the designated line. Write the word "Dollars" at the end. The key here is precision. Avoid abbreviations and use clear, legible handwriting. Avoid any ambiguity. For example, writing "1350" would be ambiguous and not accepted. The complete word must be spelled out accurately.

Step 5: Memo Section (Optional)

Use this section to briefly describe the payment, providing context. For example, you might write "Rent Payment," "Invoice #1234," or "Loan Repayment."

Step 6: Signature

Sign the check in the designated area. Your signature must match the signature on file with your bank. An inconsistent signature could flag the check as suspicious and lead to delays.

Handling Different Currency Scenarios

While this guide focuses on USD, the principles remain the same for other currencies. Ensure you use the correct currency symbol and write the amount in words accordingly. For example:

- Euro (€): One thousand three hundred fifty Euros

- British Pound (£): One thousand three hundred fifty pounds

Addressing Common Mistakes

Several common mistakes can invalidate a check or cause delays:

- Inconsistent Amounts: The numerical and alphabetical amounts must match precisely. Any discrepancy will cause problems.

- Illegible Handwriting: Ensure your writing is clear and easy to read. Avoid ambiguous letters or numbers.

- Alterations: Any alterations to the check, no matter how small, can raise suspicion and lead to rejection.

- Missing Information: Ensure all necessary fields are filled in completely and accurately.

- Incorrect Currency Symbol: Always use the correct currency symbol for the respective currency.

Advanced Considerations and Security Measures

- Using a Check Writing Software: Check writing software can help you avoid errors by automatically filling in the amount and generating legible printouts. This method eliminates the risk of manual writing errors.

- Using Check Protection Devices: These devices can print the amount in special ink that's difficult to alter, providing an extra layer of security.

- Using a Void Check: If you make a mistake, void the check immediately and create a new one. Never try to alter an existing check.

- Storing Checks Securely: Keep your checks in a safe and secure place to prevent theft or misuse.

- Reporting Lost or Stolen Checks: If your checks are lost or stolen, contact your bank immediately to prevent unauthorized use and cancel your checks.

- Regularly Reconciling Your Account: Regularly reviewing your bank statements and comparing them to your check register helps identify any discrepancies and ensures that all your payments are accurately recorded.

Understanding the Implications of Errors

Errors in writing a check, even seemingly minor ones, can have significant consequences:

- Payment Delays: Discrepancies between the numerical and alphabetical amounts can cause payment delays as the recipient's bank verifies the details.

- Check Rejection: In cases of significant errors, the check might be rejected entirely, leaving the recipient without payment.

- Fraudulent Activities: Illegible writing or inconsistent amounts can create an opportunity for fraudulent activities, exposing you to financial risks.

Best Practices for Check Writing

To minimize errors and maintain accuracy, consider the following best practices:

- Take Your Time: Rushing can lead to mistakes. Allocate sufficient time to complete the process carefully.

- Double-Check Your Work: After completing the check, thoroughly review all fields to ensure accuracy and consistency.

- Use a Template: Using a template can guide you through the check writing process, minimizing the chance of errors.

- Keep a Record: Keep a record of all checks you write, including dates, amounts, and recipients. This helps in reconciling your account and tracking your finances effectively.

Conclusion

Writing "1350" on a check, or any amount for that matter, requires precision and attention to detail. By following this comprehensive guide and adhering to best practices, you can ensure accurate check writing, minimizing the risk of errors and safeguarding your finances. Remember, consistency between the numerical and written amounts is paramount, and clear legible handwriting is essential. Always double-check your work and take your time to ensure accuracy, protecting yourself from potential financial complications. By employing these measures, you'll significantly improve the efficiency and security of your check writing process.

Latest Posts

Latest Posts

-

How Many Pounds In 2 Cubic Feet Of Mulch

Apr 05, 2025

-

How Many Cups Are In A Cool Whip Container

Apr 05, 2025

-

1 Syllable Words That Start With S

Apr 05, 2025

-

How Many Sq Ft Is 34 Acres

Apr 05, 2025

-

How Tall Is 1 63 Meters In Feet

Apr 05, 2025

Related Post

Thank you for visiting our website which covers about How To Write 1350 On A Check . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.