How To Write 350.00 On A Check

Arias News

Mar 25, 2025 · 5 min read

Table of Contents

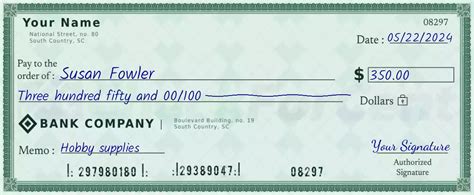

How to Write $350.00 on a Check: A Comprehensive Guide

Writing a check might seem straightforward, but ensuring accuracy is crucial to avoid complications. This comprehensive guide will walk you through the precise steps of writing a check for $350.00, covering everything from understanding the different parts of a check to best practices for security and avoiding errors. We'll delve into common mistakes and offer tips to make the process smooth and efficient.

Understanding the Anatomy of a Check

Before we jump into writing the amount, let's familiarize ourselves with the key components of a standard check:

- Check Number: A unique identifier located in the upper right corner, sequentially numbered to track your checks.

- Date: Write the date you're issuing the check. Use the month/day/year format (e.g., 03/15/2024).

- Pay to the Order of: This line is where you write the recipient's name exactly as it appears on their official identification or account information. Accuracy here is paramount. Misspelling the name can lead to delays or the check being rejected.

- Numerical Amount: This is where you write the amount in numbers. This is the section we'll focus on extensively.

- Written Amount: This is where you write the amount in words. This is a crucial security measure and must match the numerical amount exactly. Any discrepancy could lead to issues.

- Memo/Notes Section: Optional section for adding a brief description of the payment's purpose (e.g., "Rent Payment," "Invoice #123").

- Your Signature: Your signature authenticates the check. Sign it precisely as it appears on your bank's records.

Writing $350.00 on a Check: A Step-by-Step Guide

Let's break down the process of writing $350.00 accurately and securely:

Step 1: The Date

Write the current date in the designated space. Remember to use the month/day/year format (MM/DD/YYYY) to avoid any ambiguity. For example: 03/15/2024.

Step 2: Pay to the Order Of

Carefully write the recipient's full name exactly as it appears on their legal identification or account. Double-check the spelling to avoid any discrepancies. For example, if the recipient is "John David Smith," write it precisely as such. Avoid abbreviations or nicknames unless that's the official name on their account.

Step 3: Numerical Amount

In the designated area, write the numerical amount: 350.00. Ensure the decimal point is clearly visible and the cents are explicitly stated. Writing simply "350" is insufficient and could potentially be altered.

Step 4: Written Amount

This is where you write the amount in words, and where extra care is needed to prevent fraud. For $350.00, you would write:

Three Hundred Fifty and 00/100 Dollars

Crucial Points for the Written Amount:

- Start close to the left margin: This prevents anyone from adding digits in front of your amount.

- Write the number clearly and legibly: Avoid ambiguity.

- Use hyphens appropriately: "Fifty" does not need a hyphen, but numbers like "Twenty-Five" do.

- Write "and" before the cents: It clearly separates dollars and cents.

- Zeroes for cents: If the amount has no cents (as in this case), write "00/100" in the cents section. This adds an extra layer of security, showing you purposefully didn't include cents.

- Fill the space: After writing "Dollars", fill any remaining space to the end of the line with a continuous line. This prevents anyone from adding extra words or numbers.

Step 5: Memo (Optional)

Use the memo section to add a short description of the payment. For example: "March Rent," "Invoice #472," or "Loan Payment." This helps both you and the recipient track the transaction.

Step 6: Your Signature

Sign the check in the signature line. Ensure your signature matches the signature on file with your bank. A mismatched signature could lead to the check being rejected.

Common Mistakes to Avoid When Writing Checks

Several common mistakes can lead to complications. Avoiding these is crucial:

- Incorrect Spelling of Payee's Name: Always double-check spelling against official identification.

- Discrepancy Between Numerical and Written Amounts: This is a major security risk and can invalidate the check. Ensure both amounts are identical.

- Forgetting the Cents: Always include the cents, even if it's ".00".

- Leaving Spaces Unfilled: Fill any remaining spaces after the written amount to prevent alterations.

- Illegible Writing: Write neatly and clearly, ensuring both the numerical and written amounts are easily readable.

- Using Correction Fluid: Never use correction fluid or whiteout on a check. If you make a mistake, void the check and write a new one.

- Writing in Pencil: Always use pen. Pencil can be easily altered.

- Using Different Colored Ink: Use standard black or blue ink.

Security Best Practices for Checks

Security should always be a top priority when writing and handling checks:

- Keep Checks in a Secure Location: Store your checkbook in a safe place, away from unauthorized access.

- Use Check Register: Maintain a detailed record of all checks written, including the date, payee, amount, and purpose. This helps you track your finances and prevent fraud.

- Destroy Voided Checks: Properly shred voided checks to prevent misuse.

- Regularly Review Your Bank Statements: Compare your bank statements to your check register to identify any discrepancies.

- Consider Check Fraud Protection: Some banks offer additional protection against check fraud. Inquire about such options.

Handling Errors and Corrections

If you make a mistake while writing a check, do not attempt to correct it with whiteout or correction fluid. This raises suspicion and can invalidate the check. Instead, void the check by writing "VOID" across the front. Then, write a new check with the correct information.

Alternatives to Checks

While checks are still used, electronic payments offer increased security and convenience. Consider using online banking, ACH transfers, or other electronic payment methods for greater security and efficiency.

Conclusion

Writing a check for $350.00 or any amount requires precision and attention to detail. By following the steps outlined in this guide, understanding the potential pitfalls, and prioritizing security, you can ensure accurate and secure transactions. Remember, accuracy in both the numerical and written amounts is crucial, and filling any remaining spaces helps prevent fraud. Always double-check your work before handing over the check to prevent any issues later on. Consider exploring alternative payment methods for enhanced security and convenience as technology evolves.

Latest Posts

Latest Posts

-

How Many Crackers Are In A Sleeve Of Saltine Crackers

Mar 26, 2025

-

How Many Pieces Of Siding In A Box

Mar 26, 2025

-

What Is 3 4 Cup Times 2

Mar 26, 2025

-

How To Address A Letter To Multiple People

Mar 26, 2025

-

What Is Half Of 1 1 2 Teaspoons

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about How To Write 350.00 On A Check . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.