How To Write A 350 Dollar Check

Arias News

Mar 23, 2025 · 5 min read

Table of Contents

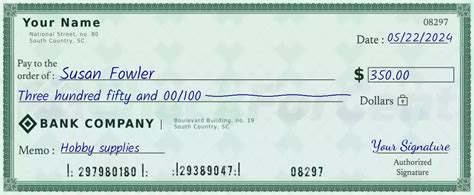

How to Write a $350 Check: A Comprehensive Guide

Writing a check might seem like a simple task, but there's a specific procedure to follow to ensure it's processed correctly and avoids potential issues. This comprehensive guide will walk you through every step of writing a $350 check, covering everything from understanding check components to preventing fraud. We'll also explore alternative payment methods and offer valuable tips for safe and efficient check writing.

Understanding Your Check Components

Before we dive into writing the check itself, let's familiarize ourselves with the key components of a standard check:

-

Your Name and Address: Located at the top left corner, this section clearly identifies the account holder. Ensure this information is accurate and up-to-date.

-

Check Number: Found in the upper right-hand corner, this unique number allows you to track your check and reconcile your bank statement. Each check has a sequential number.

-

Date: Written near the top right, this indicates the date you're issuing the check. It's important to use the current date to avoid processing delays.

-

Pay to the Order Of: This is the most crucial part. Here, you write the name of the person or entity receiving the payment. Write clearly and legibly; any ambiguity could lead to rejection.

-

Numerical Amount: This is where you write the amount in numbers. For a $350 check, you would write "350.00". Place this immediately after "Pay to the Order Of" line.

-

Written Amount: This section requires you to write the amount in words. For a $350 check, you'd write "Three Hundred Fifty and 00/100 Dollars". This acts as a safeguard against alterations. Always start writing close to the dollar sign to prevent fraud.

-

Memo/Note: This optional section allows you to add a brief description of the payment, such as "Rent Payment for July" or "Invoice #1234". This makes it easier for both you and the recipient to track the transaction.

-

Your Signature: Located at the bottom right, your signature authorizes the bank to release the funds. Ensure your signature matches the one on file with your bank.

-

Account Number: Printed at the bottom, this identifies your specific bank account.

-

Bank Routing Number: Located near the bottom, this number identifies your bank.

Step-by-Step Guide to Writing a $350 Check

Now, let's break down the process of writing a $350 check:

-

Gather Your Supplies: You'll need your checkbook, a pen (preferably a black or blue ink pen to prevent potential smudging or fading), and the recipient's full legal name.

-

Date the Check: Write today's date in the upper right-hand corner. Avoid post-dating the check (writing a future date), as this can delay payment.

-

Write the Payee's Name: Carefully write the recipient's full legal name in the "Pay to the Order Of" line. Accuracy is essential. If you're unsure of the correct spelling, double-check.

-

Write the Numerical Amount: Enter "350.00" in the designated space. Make sure the numbers are clear, legible and align with the provided space.

-

Write the Amount in Words: Write "Three Hundred Fifty and 00/100 Dollars" on the line below. Ensure there are no spaces or gaps between words and numbers. Begin writing close to the dollar sign to prevent alterations.

-

Add a Memo (Optional): Use the memo section to add a brief description of the payment. This helps with record-keeping.

-

Sign the Check: Sign the check in the designated area, ensuring your signature matches the one on file with your bank. Avoid making it difficult to recognize your signature.

-

Review Your Check: Carefully review all the information you've written. Check for any errors in spelling, numbers, and the amount written out.

Preventing Check Fraud: Crucial Tips

Check fraud is a significant problem, so it's crucial to take preventive measures. Here are some important tips:

-

Use a Check Register: Maintain a detailed record of all checks written, including the date, payee, amount, and purpose. This helps you track your spending and identify any discrepancies.

-

Use Security Features: Consider using checks with security features, such as microprinting or watermarks.

-

Use a Check Protector: A check protector embeds your check number, amount, and other key information within a protective layer.

-

Avoid Leaving Blank Spaces: Do not leave blank spaces where a fraudulent individual can alter the check details.

-

Store Checks Securely: Keep your checkbook in a safe place to prevent unauthorized access.

-

Report Lost or Stolen Checks Immediately: Notify your bank immediately if your checks are lost or stolen to prevent fraud.

-

Never Mail Checks with Other Personal Information: Send only check payment for invoices. Do not include bank information or other personal details.

-

Consider Check-21 and its Implications: Familiarize yourself with Check 21 rules, as they can affect your check security and processing speed. Check 21 is a legal framework that allows for the electronic processing of checks.

Alternative Payment Methods

While checks remain a viable option, alternative payment methods offer advantages in terms of speed, convenience, and security:

-

Online Banking: Paying bills directly from your bank account is fast, secure and traceable.

-

Debit Cards: Offering instant payment, debit cards provide a secure and convenient option.

-

Credit Cards: Convenient but carry interest if not paid in full, credit cards are widely accepted.

-

Mobile Payment Apps: Apps like Venmo, Zelle, or PayPal facilitate peer-to-peer payments and online transactions.

Choosing the Right Payment Method

Selecting the appropriate payment method depends on the specific situation:

-

Large Transactions: For significant amounts, a cashier's check might be more secure.

-

Regular Payments: Automatic payments or online bill pay offer convenience and efficiency.

-

Informal Transactions: Mobile payment apps facilitate quick transactions among individuals.

-

Emergency situations: Credit card or debit card purchases are helpful in emergency situations.

Conclusion

Writing a $350 check accurately and securely involves understanding the check components and following the proper procedure. By adhering to the steps outlined in this guide and implementing the preventive measures against fraud, you can ensure smooth and safe transactions. While checks are useful, remember to weigh the benefits of alternative payment methods for increased efficiency and security. Always prioritize protecting your personal and financial information. Regularly review your bank statements and report any suspicious activity immediately.

Latest Posts

Latest Posts

-

How Much Does A Cubic Foot Of Gold Weigh

Mar 24, 2025

-

What Is The Advantage Of Buying A Magnetic Bulletin Board

Mar 24, 2025

-

How Do You Make Light Bulb In Little Alchemy

Mar 24, 2025

-

How Tall Is An Average 7th Grader

Mar 24, 2025

-

How Many Feet Are In 288 Inches

Mar 24, 2025

Related Post

Thank you for visiting our website which covers about How To Write A 350 Dollar Check . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.