How To Write A Check For 85 Dollars

Arias News

Mar 24, 2025 · 5 min read

Table of Contents

How to Write a Check for $85: A Comprehensive Guide

Writing a check might seem like a simple task, but there's a specific procedure to follow to ensure it's processed correctly. This comprehensive guide will walk you through each step of writing a check for $85, covering everything from understanding the different parts of a check to avoiding common mistakes. We'll also explore alternative payment methods and when writing a check might be the best option.

Understanding the Anatomy of a Check

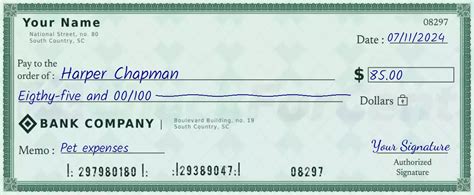

Before we dive into writing a check for $85, let's familiarize ourselves with the key components of a typical check:

-

Check Number: A unique identifier located in the upper right-hand corner. This number helps you track your spending and reconcile your bank account.

-

Date: Write the current date in the upper right-hand corner, usually in MM/DD/YYYY format. Postdating a check (writing a future date) isn't always honored by banks, so it's best to use the current date.

-

Pay to the Order Of: This is where you write the name of the person or business you're paying. Be precise and write the name exactly as it appears on their invoice or official documentation. Avoid abbreviations or nicknames. For a $85 check, if paying John Smith, write "John Smith".

-

Numerical Amount: Write the amount in numerals. For an $85 check, write "85.00". This is crucial for the bank to process the payment correctly. Place this amount close to the dollar sign to prevent fraudulent alterations.

-

Written Amount: Write the amount in words. For an $85 check, this would be "Eighty-five and 00/100". This step provides an extra layer of security against fraud. Start at the far left to prevent anyone from adding digits before the amount.

-

Memo/For: This section is optional but helpful. You can add a brief description of what the check is for, such as "Rent," "Invoice #123," or "Groceries."

-

Your Signature: Sign the check in the bottom right-hand corner. This signature authorizes the payment and verifies that the check is legitimate. Your signature should match the signature on file with your bank.

-

Your Account Number: This is printed at the bottom of the check.

-

Bank Routing Number: This identifies your bank and is also printed on the check.

Step-by-Step Guide to Writing a Check for $85

Now, let's walk through the process of writing a check for $85:

-

Date the Check: Write the current date in the designated area (MM/DD/YYYY).

-

Pay to the Order Of: Carefully write the recipient's name exactly as it appears on official documents. For example, if paying John Doe, write "John Doe" clearly and legibly.

-

Numerical Amount: Write "$85.00" in the designated box, ensuring it's close to the dollar sign.

-

Written Amount: Write "Eighty-five and 00/100" in the corresponding space. Start writing from the extreme left to fill the empty space.

-

Memo: Optionally, write a brief description of the payment purpose. For example: "Payment for Services".

-

Signature: Sign the check in the bottom right corner, ensuring your signature matches your bank's records.

-

Review: Before detaching the check, thoroughly review all entries for accuracy.

Avoiding Common Check-Writing Mistakes

Several common mistakes can cause problems with check processing:

-

Inconsistent Writing: Ensure your numerical and written amounts match precisely. Any discrepancy could lead to delays or rejection.

-

Spelling Errors: Double-check the recipient's name for accuracy. Incorrect spelling could delay or prevent payment.

-

Forgetting the Date: A missing date can cause delays or the check to be rejected.

-

Insufficient Funds: Always ensure you have enough money in your account to cover the check amount. Bounced checks can result in fees and damage your credit.

-

Illegible Handwriting: Write clearly and legibly. Unreadable checks can lead to rejection.

-

Alterations: Avoid making any alterations to the check after it's written. Attempts to alter a check can raise suspicion of fraud.

When to Use a Check and Alternatives

While checks are a traditional form of payment, they're not always the best option. Here's a comparison:

-

Checks: Suitable for paying individuals or businesses who prefer this method, providing a paper trail for record-keeping.

-

Debit Cards: Convenient for immediate transactions, offering real-time access to your bank account.

-

Credit Cards: Offer rewards programs and purchase protection, but accrue interest if not paid in full.

-

Online Banking Transfers: Quick and efficient for transferring money between accounts, usually free of charge.

-

Mobile Payment Apps: Offer convenience and speed for person-to-person payments.

Checks are still relevant in certain situations, particularly when dealing with businesses or individuals who don't accept other electronic payment methods. They also provide a physical record of your transaction, which can be useful for budgeting and tax purposes. However, electronic methods are generally faster, more convenient, and often safer.

Security Measures for Check Writing

To enhance security, consider these measures:

-

Use Check Register: Maintain a detailed check register to track your spending and prevent overdrafts.

-

Order Checks with Security Features: Many banks offer checks with security features to deter fraud, such as microprinting or watermarks.

-

Report Lost or Stolen Checks Immediately: Contact your bank immediately if your checks are lost or stolen to prevent unauthorized use.

-

Destroy Unused or Cancelled Checks: Shred unused checks to prevent fraudulent use.

-

Regularly Reconcile Your Account: Compare your bank statement with your check register to identify any discrepancies and prevent fraud.

Conclusion: Mastering the Art of Check Writing

Writing a check for $85, or any amount, requires attention to detail and accuracy. By understanding the components of a check, following the steps carefully, and avoiding common mistakes, you can ensure your payments are processed smoothly and efficiently. While alternative payment methods offer convenience and speed, checks still hold relevance for certain transactions. Prioritize security measures to protect yourself from potential fraud and maintain accurate financial records. Remember to always double-check your work before detaching the check from your checkbook!

Latest Posts

Latest Posts

-

How Many Days In A 1000 Hours

Mar 26, 2025

-

How Much Is 12 5 Ml In Teaspoons

Mar 26, 2025

-

How To Address Mail To A Widow

Mar 26, 2025

-

How Long Was Adam Alone Before Eve

Mar 26, 2025

-

How Much Is A 1 4 Lb Butter

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about How To Write A Check For 85 Dollars . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.