Which Situation Best Describes An Opportunity Cost

Arias News

Mar 22, 2025 · 6 min read

Table of Contents

Which Situation Best Describes an Opportunity Cost? Understanding the True Cost of Choices

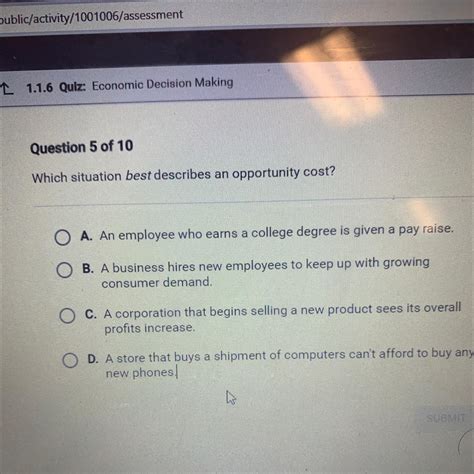

Opportunity cost. It's a fundamental concept in economics, yet often misunderstood. Simply put, it's the value of the next best alternative forgone when making a decision. It's not just about the money spent; it's about what you could have gained by choosing differently. This article dives deep into the concept of opportunity cost, exploring various scenarios to illustrate its profound impact on our decisions, both big and small. We'll analyze different situations, demonstrating how to identify and calculate opportunity cost, and how understanding it can lead to better decision-making.

Understanding the Core Concept: What is Opportunity Cost?

Before we delve into specific examples, let's solidify our understanding of opportunity cost. It's not about the total cost incurred. Instead, it's specifically about the value of the best alternative you gave up. This is crucial because it highlights the trade-offs inherent in every choice.

Think of it this way: you have a limited amount of resources – time, money, energy. Every decision you make allocates these resources in a specific direction. The opportunity cost represents the potential benefits you miss out on by not choosing the next best alternative.

Example: Imagine you have $1000 to invest. You can either invest it in stocks, which have a projected return of 10%, or in bonds, with a projected return of 5%. If you choose to invest in stocks, your opportunity cost is the potential 5% return you would have earned from investing in bonds. This is your next best alternative.

Scenarios Illustrating Opportunity Cost

Let's examine diverse situations to illustrate the concept more vividly:

1. Choosing a Career Path: The High-Stakes Opportunity Cost

One of the most significant decisions with profound opportunity cost implications is choosing a career path. Suppose you're exceptionally talented in both software engineering and graphic design. You decide to pursue a career in software engineering, earning a high salary. Your opportunity cost? The potential income and personal fulfillment you could have gained as a successful graphic designer. This extends beyond just finances; it also includes potential networking opportunities, creative satisfaction, and work-life balance differences between the two careers. The higher the potential earnings or satisfaction of the forgone option, the higher the opportunity cost.

Calculating Opportunity Cost (in this case, it’s qualitative): Precise calculation isn't always possible, especially when dealing with qualitative factors like job satisfaction. However, a comparative analysis weighing the potential salary, career growth, and personal fulfillment of both careers provides a reasonable estimation of the opportunity cost.

2. Investing Time: The Value of Leisure vs. Productivity

Time is a finite resource. Every minute spent on one activity represents a minute not spent on another. Let's say you have a free weekend. You can either spend it relaxing and catching up on your favorite shows (leisure), or dedicate it to working on a freelance project that could earn you extra income (productivity). If you choose leisure, your opportunity cost is the potential income you could have earned from the freelance project. Conversely, if you choose the freelance project, your opportunity cost is the relaxation and enjoyment you could have experienced during the weekend.

Calculating Opportunity Cost (quantifiable): This scenario allows for a more straightforward calculation. The opportunity cost of leisure is the potential income from the freelance project. The opportunity cost of working is the value you place on your leisure time (which could be subjectively determined based on how much you value relaxation).

3. Educational Choices: Master's Degree vs. Immediate Employment

After graduating with a bachelor's degree, you face a decision: pursue a master's degree, delaying your entry into the workforce, or immediately enter the job market and start earning a salary. Choosing a master's degree means forgoing the salary you could have earned during those extra years of study. Your opportunity cost is the potential income earned during that period, plus any potential career advancement that you might have secured had you entered the workforce earlier.

Calculating Opportunity Cost (quantifiable): This can be calculated by estimating the potential salary you would earn during the years of studying for your master's degree. Account for potential salary increases over time and adjust for inflation.

4. Household Decisions: New Car vs. Home Improvement

Let's say you have $30,000 saved. You are debating between buying a new car and renovating your kitchen. If you buy the new car, your opportunity cost is the improved living space and potential increase in home value that the kitchen renovation would have provided. Conversely, choosing the renovation means foregoing the convenience and enjoyment of a new car.

Calculating Opportunity Cost (quantifiable & qualitative): You can compare the estimated cost of the new car ($30,000) with the estimated cost of the kitchen renovation. This provides a quantifiable comparison. However, also consider the qualitative factors: the improved home value, the enjoyment of a new car, the convenience of a new car compared to the long-term benefits of a renovated kitchen. This balance must be considered when choosing the best option.

5. Business Decisions: Marketing Strategies & Resource Allocation

Businesses constantly grapple with opportunity cost. Let’s consider a company with a limited marketing budget. They must decide how to allocate their resources: invest in digital marketing (SEO, social media) or traditional marketing (print ads, television commercials). If they choose digital marketing, the opportunity cost is the potential return they might have achieved through traditional marketing. This requires thorough market research and understanding the ROI potential of each approach.

Calculating Opportunity Cost (qualitative & quantifiable): Business decisions often involve calculating the ROI (return on investment) of different marketing strategies. The opportunity cost is the potential ROI from the forgone marketing approach. This requires a deep understanding of market trends, target audience, and the effectiveness of different channels. This is where market research and data analytics become crucial.

Identifying and Minimizing Opportunity Costs

While completely eliminating opportunity cost is impossible, understanding it empowers you to make more informed decisions. Here's how:

-

Clearly Define Your Goals: Knowing what you want to achieve helps prioritize your choices and assess the relative value of different options.

-

Conduct Thorough Research: Gather information about the potential benefits and drawbacks of each alternative.

-

Assess the Risks and Rewards: Consider the potential downsides and upsides associated with each option, including both quantifiable and qualitative factors.

-

Consider Long-Term Implications: Don't just focus on immediate gains; think about the long-term consequences of your choices.

-

Be Flexible: Recognize that your priorities and circumstances can change over time, and be prepared to adjust your plans accordingly.

-

Regularly Review Your Decisions: Periodically assess whether your choices are still aligned with your goals and if adjustments need to be made.

Conclusion: Opportunity Cost - A Constant Companion in Decision-Making

Opportunity cost is an omnipresent factor in every decision we make. From personal choices to significant business strategies, understanding this concept helps us evaluate the true cost of our actions. By consciously considering the value of forgone alternatives, we can make better-informed choices, leading to improved outcomes in all aspects of our lives. It’s not just about avoiding mistakes; it’s about maximizing the value of our limited resources and making choices that align most closely with our objectives. Remember, the next best alternative isn't just an afterthought; it's a fundamental component of any successful decision. Mastering the art of evaluating opportunity cost empowers you to make smarter decisions, paving the way for more fulfilling and successful experiences.

Latest Posts

Latest Posts

-

What Is A Shape With 15 Sides Called

Mar 22, 2025

-

How Many Dry Quarts Are In A Cubic Foot

Mar 22, 2025

-

What Is 3 4 Of A Tablespoon

Mar 22, 2025

-

Cups Of Chocolate Chips In 12 Oz

Mar 22, 2025

-

What Year Was I Born If I M 17

Mar 22, 2025

Related Post

Thank you for visiting our website which covers about Which Situation Best Describes An Opportunity Cost . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.